Elon Musk's private jet rider

Trump's tariffs, is Hermès the Warren Buffett of luxury? and a close look at LVMH vs Hermès. All this and more in this week’s luxury news round-up.

Welcome to our new subscribers who found Dark Luxury via the Independent’s story about Chinese factories, and readers from Tiffanie Darke’s It’s Not Sustainable. We’re happy to have you, especially in the middle of such a topsy turvy, epoch defining moment for the luxury industry. We wouldn’t have been able to make it up even if we tried.

Now, on with this week’s news round-up.

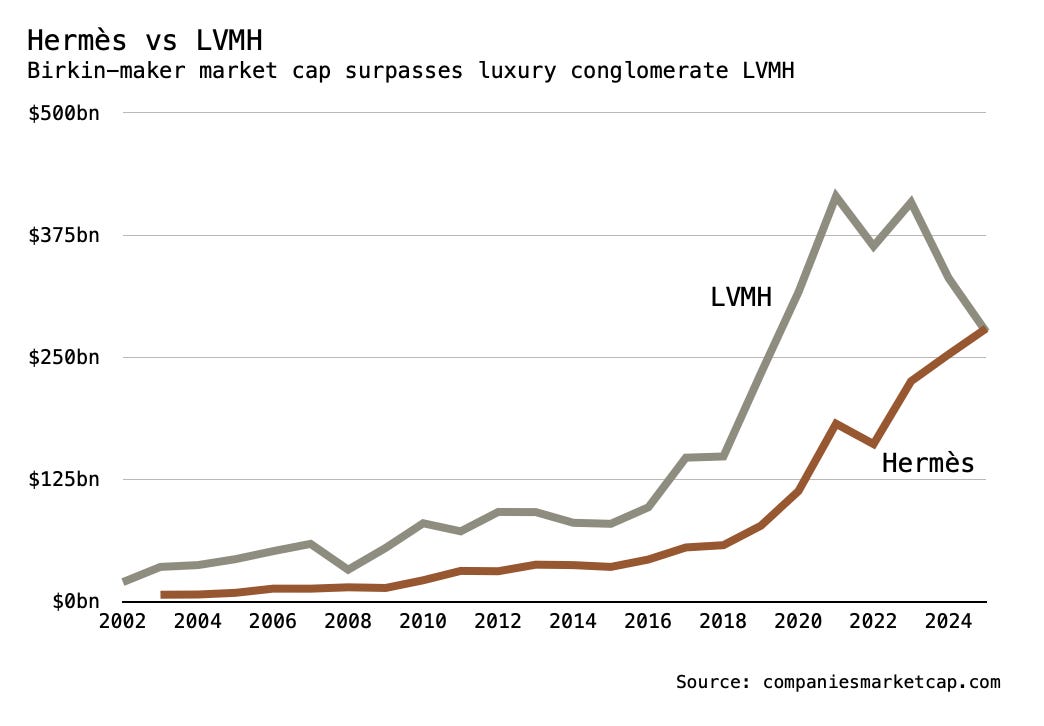

LVMH vs Hermès

Is Hermès, with its slow and steady approach, the Berkshire Hathaway of luxury? The news is on the front page of the FT today: Hermès is worth more than LVMH, and the £50 billion gap in the valuation of the two luxury companies that was there in February has disappeared. That’s an astonishing development for Hermès, a company that was once a takeover target of LVMH CEO Bernard Arnault. What does this mean? In financial terms, it represents the market’s expectations of the future value of the two companies, and the market now expects Hermès will maintain its value better than LVMH.

Hermès’ rise has been achieved thanks to its emphasis on exclusivity, rarity, rock solid high prices and consistent creative excellence. This mirrors the decline of LVMH, whose brands have become steadily less exclusive and creative, more available online, and some of which are even (shock horror) available for a discount. Making things worse, LVMH kicked off the year with a big miss on its organic sales numbers for fashion and leather, which were down 5 per cent, worse than the 0.55 per cent predicted by analysts.

As you’ll remember from our coverage of Hermès’ 2024 results, the firm is sitting on a pile of cash at least equal to its annual revenue, and its product and pricing strategy has created a thriving secondary market: walk out of an Hermès boutique with a Birkin and you’ve just made a 200 per cent gain.

Louis Vuitton’s handbags, meanwhile, have recently been “trading sideways” on the secondary market, retail staff are expressing their annoyance on Glassdoor reviews, and its open-door retail policy has fuelled a thriving grey market in China.

Reuters’ Yawen Chen makes another great point that LVMH’s opaque succession merits an investor discount. Arnault’s lack of a succession plan and the lack of clarity about when investors might get one “is beginning to weigh on the group’s enviable stock market record,” she writes. Remember the scene in Succession when Logan dies and Roman takes a peek at Waystar Royco’s plummeting stock price? There’s a cost to being king, and Arnault’s children are looking increasingly likely to pay it.

Enjoying Dark Luxury? Get access to our exclusive investigations, analysis and interviews by becoming a paid subscriber.

Tariffs and manufacturing

The after-effects of Donald Trump’s massive and illogical tariffs on China and its allies are still rattling their way through the markets. Even worse than the immediate effect on share prices and demand is the uncertainty his policies have introduced, says Citigroup analyst Thomas Chauvet in the FT, who believes it is "difficult to build a credible scenario" for revenue improving in the luxury sector in the coming quarters.

This week we want to highlight two excellent pieces of reporting on the problems with the idea of onshoring manufacturing to the US. First, from Dana Thomas, whose substack asks whether on-shoring production is even possible. Second, from Reuters’ Tassilo Hummel and Waylon Cunningham, who have been investigating LVMH’s efforts to make $1,500+ handbags in Texas.

The sums don’t add up

Here’s Thomas with some simple sums on why bringing fashion manufacturing back to the US is not possible at the scale demanded by US consumers, recalling her work on her 2019 book.

“When I visited garment factories in Bangladesh for Fashionopolis, workers were earning $68 a month… What major fashion CEO wants to go back to paying garment workers US minimum wages—in California, the largest garment-producing region in the country today, it’s $16.50 an hour—plus benefits?”

These simple sums explain why Trump’s plan (if you can call it that) is never going to work without also onshoring the sweatshop culture that makes the “luxury margins” work. Slave-labour practices are already present in parts of the luxury industry’s supply chain, but they remain in the margins. Trump’s tariffs, if fully realised, would bring the sweatshops back to New York’s Garment District. Who usually works in sweatshops? Poorly paid and badly treated immigrants. And round and round we go in Trump’s illogical wonderland.

Thomas joins the dots between Trump’s dream and this reality. “Even if the president’s trade war does bring manufacturing back to the United States, the country no longer has the skilled labor to staff factories like Louis Vuitton’s, which require sewing by hand, rather than by robots”, writes Thomas. “The glorious return of fashion manufacturing to the United States, as the Trump administration envisions it is a romantic fantasy that cannot possibly happen in the short term, and most likely not in the long term either”. (The Style Files)

LVMH’s faltering efforts to make handbags in Texas

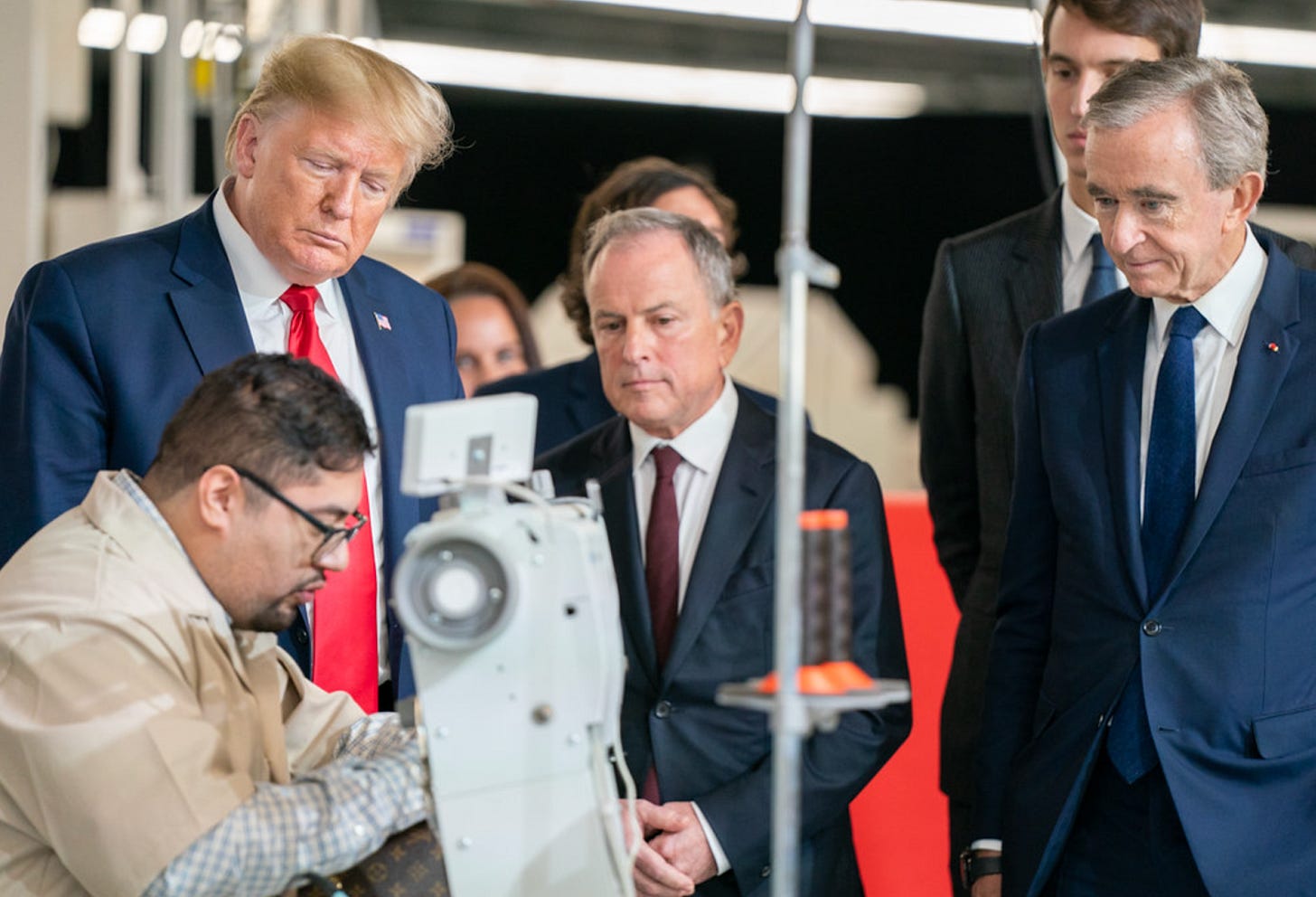

Then there’s Reuters’ extremely timely reporting on LVMH CEO Bernard Arnault’s efforts to onshore the making of luxury handbags in Alvarado, Texas. Famous for defining his love of luxury because “it is the only area in which it is possible to make luxury profit margins”, Arnault barely compromised on this maxim by opening its Alvarado plant in Texas.

Even with a gigantic property tax discount worth an estimated $29 million over ten years from Johnson County, the factory has only 300 workers, far fewer than the 1,000 that Arnault hoped back in 2019. And the output isn’t up to scratch, either. Workers at the Alvarado plant are being paid $17 an hour, yes, but they are reportedly struggling to make “simple pockets” for Louis Vuitton’s Neverfull handbag, they’re wasting nearly half of the leather hides that go into making them, and they’re cutting corners like using hot pins to melt canvas bags to conceal imperfections.

Louis Vuitton's industrial director Ludovic Pauchard said the company was being “patient” with “a young factory”, but in retrospect, it appears to us that this whole Texas plan was more about getting President Trump to attend the ribbon-cutting ceremony, and keeping him on-side if did go down the tariff route later on. Not that this worked either. (Reuters)

Dupe factories in China give great TikTok game

Dark Luxury spoke to The Independent this week about why factories in China are posting videos on TikTok encouraging Americans to buy direct from the factory, after Trump imposed 145 per cent tariffs on Chinese imports. The videos make outright false or at least ambiguous claims about the sources of the materials and products sold by luxury firms, and as I told reporter Richard Hall, they commonly link to websites selling potentially counterfeit and certainly “duped” luxury products.

The phenomenon is a great case study in why luxury firms should be more open with their supply chain data, so viewers (and reporters like Hall and myself) can quickly check these claims. To their credit, Lululemon publishes its full supplier list online in a PDF. How about an interactive map that updates every month? (The Independent)