Luxury’s ‘Liberation' day

Trump's radical tariffs and their impact on watches, superyachts and other luxury goods

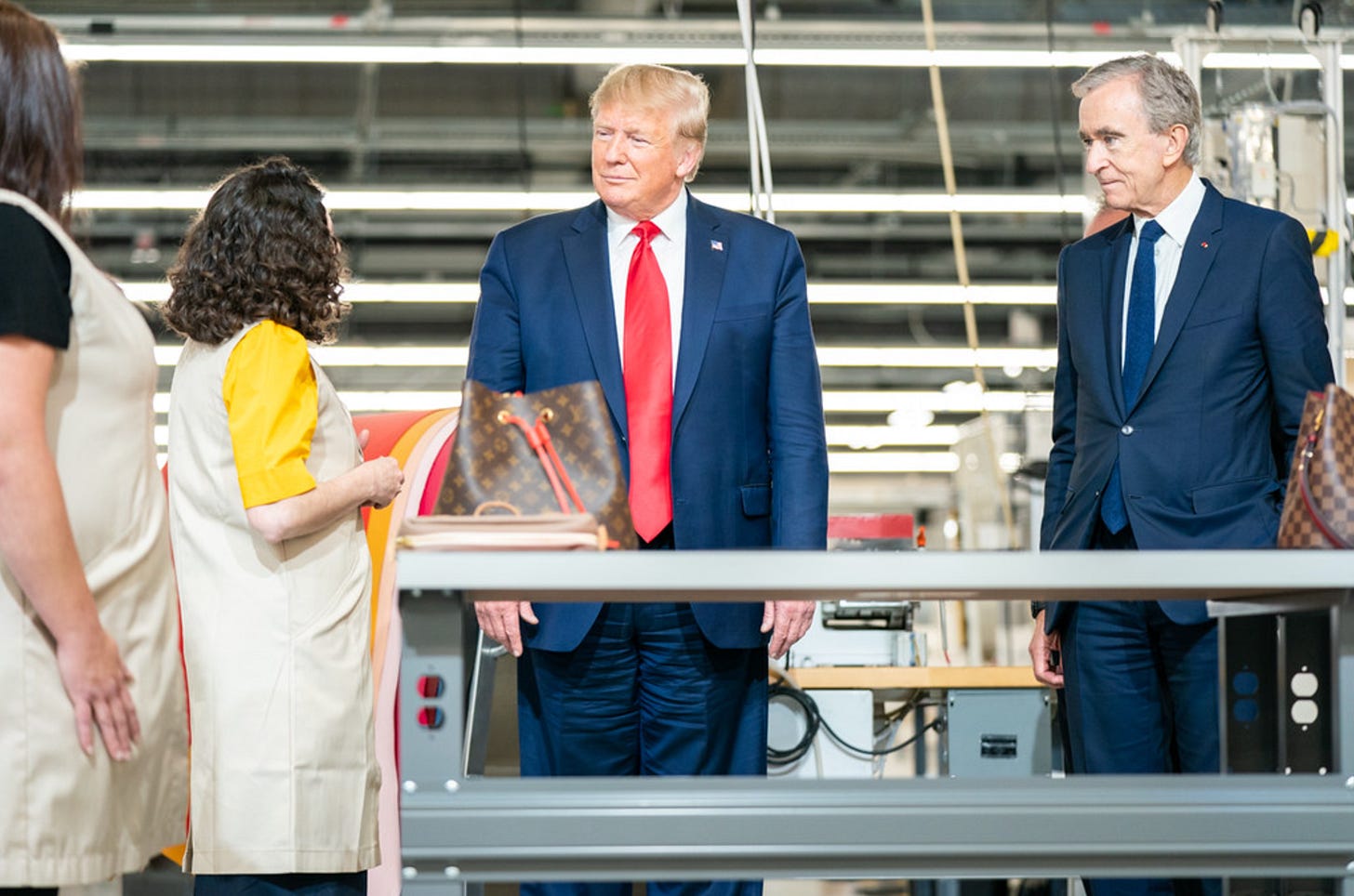

“Even Bernard Arnault couldn’t save European luxury from Donald Trump’s tariffs”, wrote Andrea Felsted in her Bloomberg opinion column yesterday.

Yes, despite calling Trump to offer friendly words the day after the failed assassination attempt, flying across the Atlantic with son and daughter in tow to attend Trump’s inauguration, his son Alexandre’s undignified appearance at his Madison Square Garden rally and Paris Match’s favourable articles, Trump still whacked a 20 per cent tariff on almost everything imported into the US from the EU, including Arnault’s Louis Vuitton handbags. No wonder Kering’s Pinault didn’t bother with all that.

As they say in business, it’s not personal. In this case, it’s not even business-minded. “Trump’s tariffs were determined by a crude, and, well, stupid formula that made no economic sense. It’s still an open question whether that formula was determined by some junior staffer or derived from ChatGPT and Grok”, wrote economist Paul Krugman.

It’s also not the first time Trump has tried to achieve a policy goal with tariffs. In 2019, Trump increased tariffs on Chinese furniture which simply led to a 1:1 increase in furniture prices. US domestic furniture production declined. “This is the opposite of what the administration believed would happen”, wrote JPMorgan Asset Management’s Michael Cembalest in his Eye on the Market note.

Putting all this together, our advice to luxury leaders at companies trying to predict what Trump is going to do: believe him when he says what he’s going to do, and consider the opposite might happen when he says what it’ll achieve.

How this affects luxury

Some might say that mass luxury brands have been due a reckoning. Rampant price inflation accompanied by often decreasing quality has contributed to slowing demand for luxury goods for some time now.

Prices have already increased by 60 per cent compared with before the pandemic. That leaves luxury firms with fewer options as Trump’s tariffs come into effect. The obvious reaction to tariffs is to raise prices, but consumers are a bit sick of paying more money for lower quality luxury items.

LVMH at least has the ability to expand production in the US and avoid some of those tariffs, having expanded its factories in Texas and California. Gucci-owner Kering’s share price has been hammered particularly hard, perhaps because of its long-running issues with profitability and the fact that it has no US production capacity.

Also potentially damaging are the tariffs of up to 49 per cent on exports from China, Vietnam, Bangladesh, Cambodia and Indonesia, which will particularly affect sportswear brands. Vietnam produces 40 per cent of Lululemon’s products, to cite one example. LVMH gets 17 per cent of supply by volume from Asia, which could be subject to those higher tariffs if they supply factories in America.

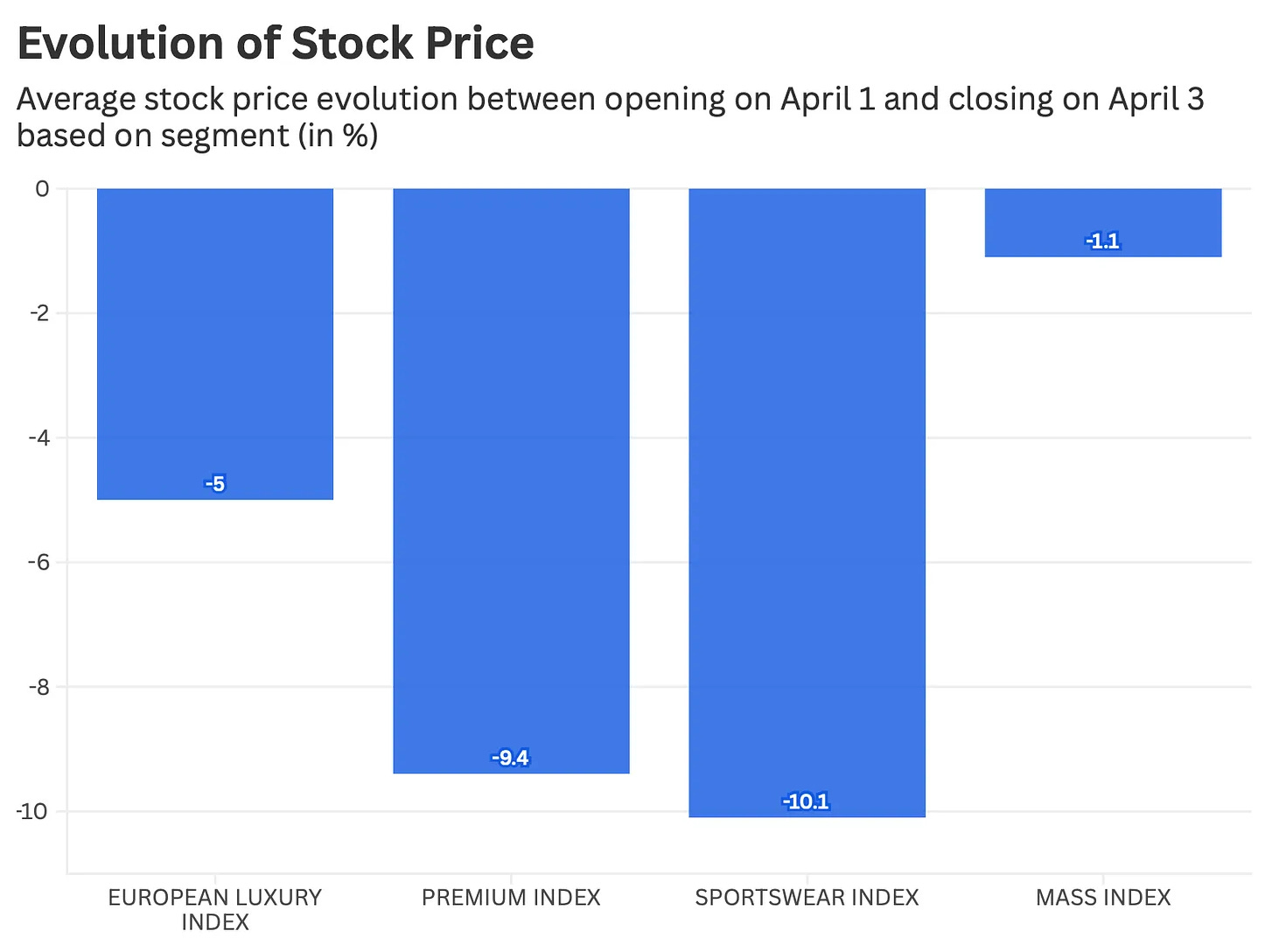

Stock market moves should be seen in a relative context, and luxury firms are not the worst-off relative to other industries, neatly illustrated here by Francois Souchet’s chart. But that will be little comfort to the business leaders at luxury firms trying to decide whether to hike prices or swallow the tariffs and hit their profit margins. There are no good choices.

As for the direct effect of the tariffs, “they’re equal to a doubling of the corporate tax rate”, according to some estimates cited by JPMorgan’s Michael Cembalest. But things could also get a lot worse than a big, temporary drop in share prices.

JPMorgan’s Chiara Battistini wrote in her note to clients that the risks for luxury are not just on the profit margins side (which are and will be squeezed by tariffs) but on the short and medium term impacts on consumer confidence and higher inflation. That note was written before China said it will fire back with 34 per cent tariffs on US exports, matching Trump’s back-of-a-ChatGPT tariff calculation.

There’s also the longer term risk that this will kick off a global trade war and ever-escalating tariffs, eventually leading to some kind of re-run of the Great Depression. Fortunately, the Great Depression wasn’t made in a day, and if that happens the world will have bigger problems than declines in luxury stock prices.

Some financial experts who have recently commented on luxury may certainly be feeling a bit sheepish today. Former Saks Fifth Avenue and Toys "R" Us CEO Gerald Storch, who now runs Storch Advisors, a global business and management advisory firm, said on 7 January, speaking to Yahoo Finance’s Madison Mills, “I don’t see it being as bad as everyone’s talking about,” about the prospects of Trump’s potential tariffs on luxury, adding, “I don’t think that we should assume the administration is stupid in what they’re doing”. That is clearly not a safe assumption.

That said, no-one has a crystal ball, and there are at least two major exemptions for the blanket 10 per cent tariffs (pharmaceutical products and oil, gas and refined fuels), so we’ll see what Bernard Arnault can pull out of the bag.

For the rest of today’s newsletter we’re focusing on rounding up the immediate impacts of Trump’s tariffs on different luxury sectors from watches to handbags to cars.

There aren’t any winners, but there are some lesser losers, as you’ll see.

Enjoying Dark Luxury? Get access to our exclusive investigations, analysis and interviews by becoming a paid subscriber.